Itr V Acknowledgement 2013 14

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year [Where the data of the Return of Income in Benefits in Form (ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-V ITR-4, ITR-4S (SUGAM), ITR-5, ITR-6 transmitted electronically without digital signature]. 2013 - 14 (Please see Rule 12 of the Income-tax Rules, 1962) Name SHYAM SINGH PAN AXJPS6305C Flat/Door/Block No 331 Name Of Premises/Building/Village Road/Street/Post Office Area/Locality CHATTARPUR VILLAGE Town/City/District State Form No.

Jul 16, 2015 - Submit ITR V for AY 2013-14 and 2014-15 till 31st October. Returns/firms' and then click on the relevant Acknowledgment No. Sep 15, 2014 - CPC-Send Signed ITR -V Acknowledgements for AY 2013-14 by 31st. Signed copy of the acknowledgement of the filing of return (ITR-V) to.

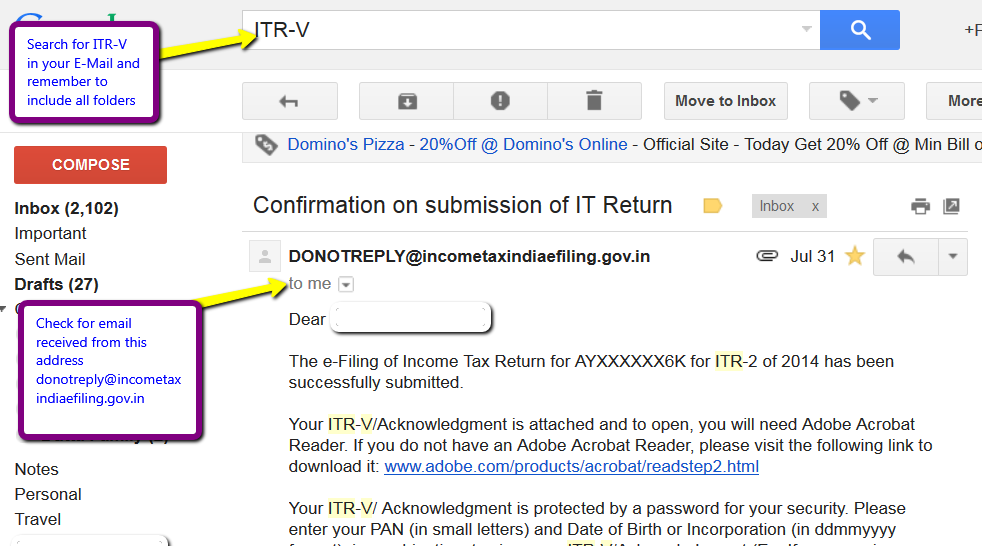

Most of income tax returns are filed online and taxpayers are giving the computerized printed copy as an acknowledgement of Income Tax Return, called as ITR-V. Therefore it is difficult for bankers to check the genuineness of ITR as it is just computerized printed pdf copy. Following are the two options for verification of ITR acknowledgement. Option 1 – Download Online The best option of verification of ITR- V is to ask the taxpayer to login income tax e-filing website () and download the ITR-V in front of bankers to check its genuineness. In this process bankers can get the genuine ITR on his own computer.

But most of taxpayers do not remember the password or they do not have password as return is filed by tax professionals and it is not practically possible to follow this procedure for each banker. Option 2 – Verify the ITR-V Receipt status When banker wants to check the genuineness of ITR and when online login of taxpayer is not possible then the banker has following option to verify the ITR acknowledgement:- Click on the given link below: Give the input of 1. PAN / e-Filing Acknowledgement number 2.

Megamendung Batik Background Vector. Choose from thousands of free vectors, clip art designs, icons, and illustrations created by artists worldwide! 641 Best Batik Mega Mendung Free Vector Art Downloads from the Vecteezy community. Batik Mega Mendung Free Vector Art licensed under creative commons, open source, and more! Looking for free vectors of Batik Mega Mendung? Browse our collection of Batik Mega Mendung templates, icons, elements, presentations, silhouettes and much more! No purchase required. Sejarah batik mega mendung. Batik Mega Mendung Clip Art Download 118 clip arts (Page 1) This site uses cookies. By continuing to browse you are agreeing to our use of cookies and other tracking technologies. Looking for free vectors of Desain Batik Mega Mendung? Browse our collection of Desain Batik Mega Mendung templates, icons, elements, presentations, silhouettes and much more!

Assessment year 3. And image i.e. Captcha Code When you give the PAN and other Details you will get the ITR-V status in following ways 1. When return is not filed, you will get the status as “No return has been filed for this PAN and assessment year or e-filing acknowledgement number” 2. When return filed and it is digitally signed then you will get the status as -“E-return for this assessment year or acknowledgement number is digitally signed” 3. When return filed and it is NOT digitally signed then there are two possibilities a. ITR filed online but signed acknowledgment is NOT received by Income Tax Department – CPC, Bangalore – You will get the status as ITR-V not received b. ITR filed online but signed acknowledgment is received by Income Tax Department – CPC, Bangalore – You will get the status as ITR-V received It is also advisable to the bankers to verify status of ITR–V on PAN as well as e-filing acknowledgement number basis.

As return many be filed but acknowledgement many be fabricated. Drawbacks of verification by second option We can verify only PAN and acknowledgement number but not data (like gross total income, taxes paid, etc,).

If PAN and acknowledgement number is correct, but other data of the ITR-V is fabricated, then it is not possible to track such fabrication in this verification method. Observe ITR-V carefully Banker can also verify the ITR-V on the basis of some observations tools (applicable when return is not digitally signed), as given below: 1.Confirm that last six digits of acknowledgement number is date of filing return, as mentioned on the acknowledgement. Check bar code carefully, the first 10 characters is the PAN, also check bar code also contain 15 digits acknowledgement number.

Gunze touch screen driver windows 7 0. Banker can also cross verify the contents of ITR-V with tax challans and TDS certificate, Form 26 AS and other financial statements. If banker verify the ITR-V carefully as explain above then they can easily track the genuineness of ITR.

Dear Sir, I have got an SMS stating – processing of the ITR Ack No. 706 AY 2017-18 is not completed due to income mismatch.

Details are not to your e-mail id. Kindly check and respond. I need you help – I filed my income tax return myself for the first time. There may be some discrepancy. I did not get any mail as indicated. Despite by best efforts and despite having the advise from the CPC; I could not trace out the above information.